While we were monitoring TON, on the evening of May 11, another important event in the world of cryptocurrencies took place. It was the third bitcoin halving, which everyone was eagerly waiting for. Curiously, several countdown timers indicated that the halving would happen on May 12, but due to a higher network speed, this happened a day earlier.

The main objective of this mechanism, which was laid down in the protocol of the blockchain network more than ten years ago, is to control the emission of cryptocurrency and curb its inflation. Each new block is lined up with the previous blocks – this is where the name of the blockchain comes from. Block contains information on all transactions processed in 10 minutes, including a hash of transactions, addresses of wallets from which, and where bitcoins were transferred.

So halving is cutting the reward that miners receive by half, which means that on Monday, the reward per one new block was cut from 12.5 new coins to 6.25. In the Bitcoin network, halving is programmed in every 210 thousand blocks, which is every four years. Cryptocurrency emission is limited to 21 million BTC. Presumably, the last coin will be mined in 2140.

With #Bitcoin slated to expand supply 1.8% over the next year, $BTC now has lower inflation than 99% of the assets out there.

— Chris Burniske (@cburniske) May 11, 2020

This one is the third halving already. At the dawn of the emergence of bitcoin, miners received 50 BTC for each mined and recorded block. After the first halving on November 28, 2012, the remuneration was reduced to 25 BTC, and after the second on July 9, 2016 – to 12.5 BTC. Now, the amount of remuneration is half as much – 6.25 BTC.

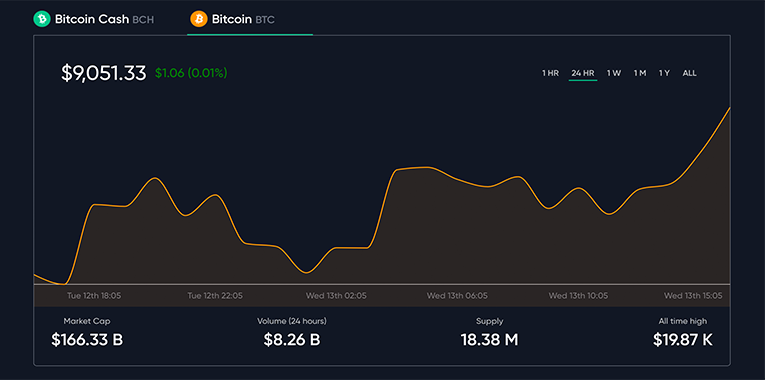

The first two halvings in the bitcoin network were accompanied by increased coin volatility. In November 2012, when the first halving took place, the Bitcoin exchange rate was $11, but by the fall of 2013, it reached $1,100. Later, the rate fell to $200. In July 2016, when the second halving took place, Bitcoin was worth $600, but after halving in 2017, the cryptocurrency rate went up and reached a record of $20,000 in mid-December, after which it plummeted.

There is no consensus on the influence of the third halving. Some give fantastic predictions of unprecedented growth, while others believe that no significant changes will occur.

Over the last month before halving, the bitcoin exchange rate rose by 26%, and a week ago, the cryptocurrency soared to $10,000 for a short while. But then began to fall again – at the moment, the rate is about $8,900 per BTC.