Discover the Potential of Trustiva

In today's dynamic financial landscape, having the right trading tools is essential for success. This article delves into the features and benefits of Trustiva, providing an in-depth analysis of its capabilities to help you make informed decisions.

Understanding Trustiva

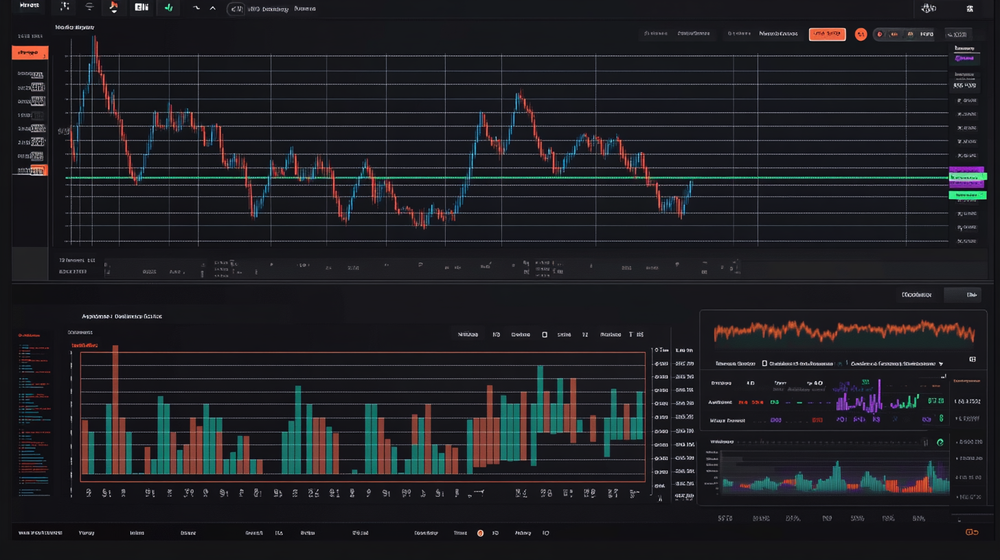

Trustiva is a state-of-the-art trading platform designed to empower traders with powerful analytical tools and features. Its primary function is to provide real-time market data, automated trading capabilities, and a host of customizable options that together create a seamless trading experience. As a significant player in the financial technology field, Trustiva stands out for its commitment to delivering efficiency and enhanced user satisfaction.

Trustiva's Standout Features

- Real-time Market Data: Provides traders with live data to make timely and informed decisions.

- Automated Trading: Allows users to set parameters for trading algorithms, streamlining the trading process.

- Customizable Interface: Trustiva lets users tailor their dashboard to suit their preferences and trading style.

- Risk Management Tools: Equipped with stop-loss and limit orders to secure investments.

- Educational Resources: Offers tutorials and webinars for continuous learning.

- Multi-Device Compatibility: Operates efficiently on both desktops and mobile devices.

- 24/7 Customer Support: Ensures assistance is available whenever needed.

Evaluate Trustiva: Pros and Cons

Benefits

- Ease of Use: User-friendly interface simplifies navigation for all users.

- Innovative Tools: Trustiva provides cutting-edge trading tools for making informed strategies.

- Swift Processing: Fast trade execution minimizes risk.

- Comprehensive Guidance: Extensive support resources offer thorough help and guidance.

- Regular Updates: Consistent enhancements and security updates keep the platform current.

- Secure Transactions: Advanced security protocols protect user data and transactions.

Drawbacks

- Premium Features Cost: Advanced tools and features often come with a subscription fee.

- Initial Learning Curve: The complex array of functionalities can be initially challenging for newcomers.

- Occasional Downtime: Trustiva may experience brief maintenance periods that affect accessibility.

Step-by-Step Startup Guide for Trustiva

- Sign Up: Begin your journey by creating an account on the Trustiva platform.

- Deposit Funds: Start trading with a minimum deposit of $250 to fuel your trading activities.

- Try the Demo Account: Familiarize yourself with the platform features in a risk-free environment.

- Set Trading Parameters: Customize your trading preferences to align with your strategy.

- Start Live Trading: Dive into live trading and leverage Trustiva's capabilities to maximize your potential earnings.

- Withdraw Funds: Manage your earnings with ease, benefitting from a withdrawal process completed within 24 hours.

Final Thoughts on Trustiva

In conclusion, Trustiva presents itself as a robust and versatile platform well-suited for traders seeking a comprehensive and efficient trading experience. With its innovative features, user-friendly design, and exemplary support, it proves to be a valuable ally in the financial market. Whether you're a novice or experienced trader, Trustiva offers the tools and resources necessary to navigate the trading landscape effectively.