Tech Giants Lead Market Resurgence

In an unexpected twist on Wall Street, megacap tech stocks have taken the spotlight, leading a resurgence in the S&P 500 despite challenges in other sectors. Analysts have noted that the average stock’s performance has lagged, evident from the decline in the Invesco S&P 500 Equal Weight ETF. While lower interest rates often encourage broad market rallies, the recent uptick in the 10-year Treasury yield has coaxed investors back into the welcoming arms of large-cap technology stocks.

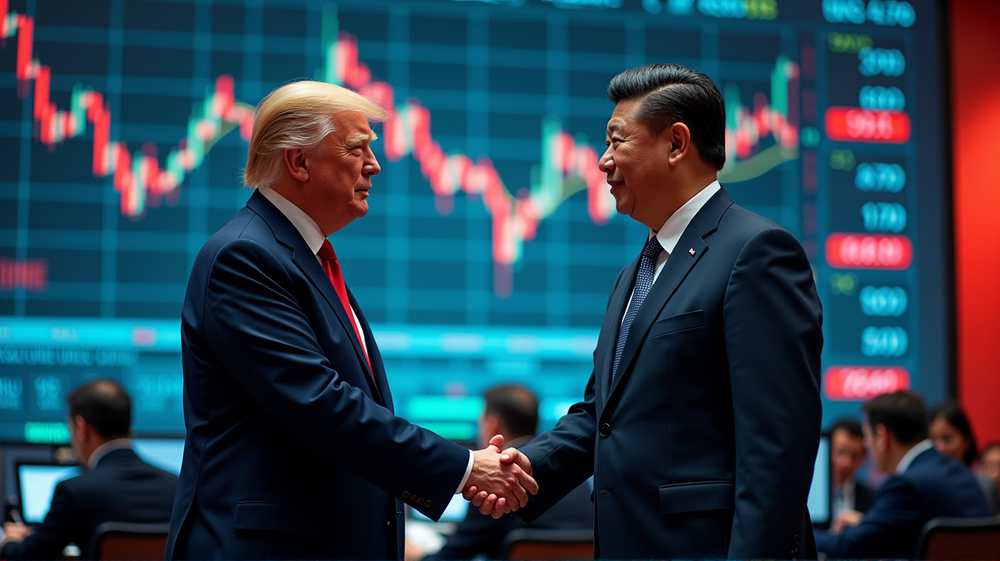

Trump and Xi’s Progress Paves Path for Trade Talks

Adding a diplomatic feather to Wall Street’s cap, President Donald Trump engaged in a meaningful dialogue with Chinese President Xi Jinping. This meeting, eagerly anticipated by global investors, concluded with a significant development — a deal allowing a consortium of investors to manage TikTok’s U.S. operations. Trump took to Truth Social, expressing the productive nature of the call, which touched upon diverse issues from trade to the Russian-Ukrainian conflict.

Energy Sector and Power Stocks Hold Steady

In tandem with tech, power stocks seem relentless in their upward journey, buoyed by new governmental initiatives. The latest Energy Department’s “Speed to Power” project is receiving praise for its foresight in addressing electricity demand driven by AI proliferation and domestic manufacturing. Companies like GE Vernova and Eaton have begun to see positive ripples in the market as investors tune into these promising undertakings.

Upcoming Market Movers and Economic Indicators

With a new week on the horizon, investors are eyeing key earnings reports from industry giants such as Costco and Micron. Additionally, economic data releases — including the S&P Global PMIs and the PCE price index — are poised to guide market sentiments and possibly influence Federal Reserve actions moving forward.

A Note of Caution for Investors

Lastly, members of the CNBC Investing Club with Jim Cramer are reminded to adhere to trading protocols, ensuring compliance with established terms and conditions. While the current market highlights the potential for growth, seasoned investors are keeping an eye on economic shifts and political developments, aiming for informed and strategic decision-making. As stated in CNBC, maintaining vigilance in this dynamic environment remains crucial for long-term success.