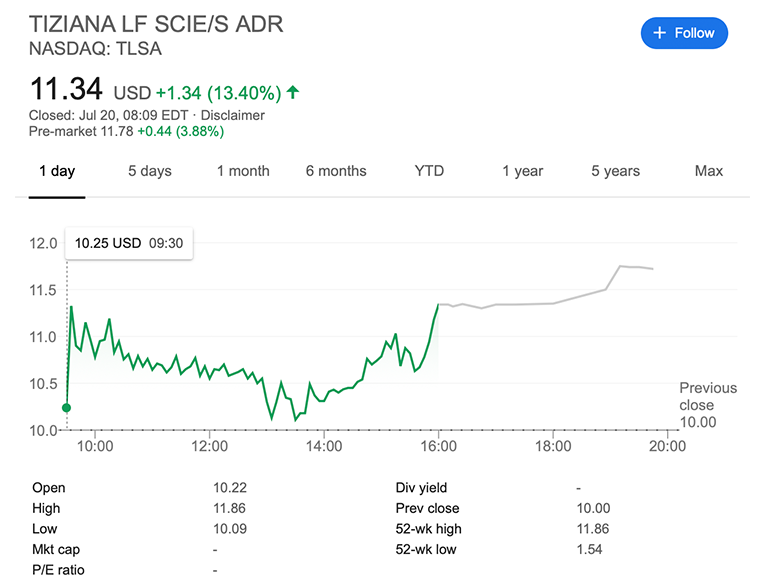

Despite the lack of revenue, and unprofitable British biotechnological company Tiziana Life Sciences increased its capitalization. It happened due to the carelessness of investors who confused the TLSA ticker with the TSLA ticker used by Tesla, the manufacturer of electric cars.

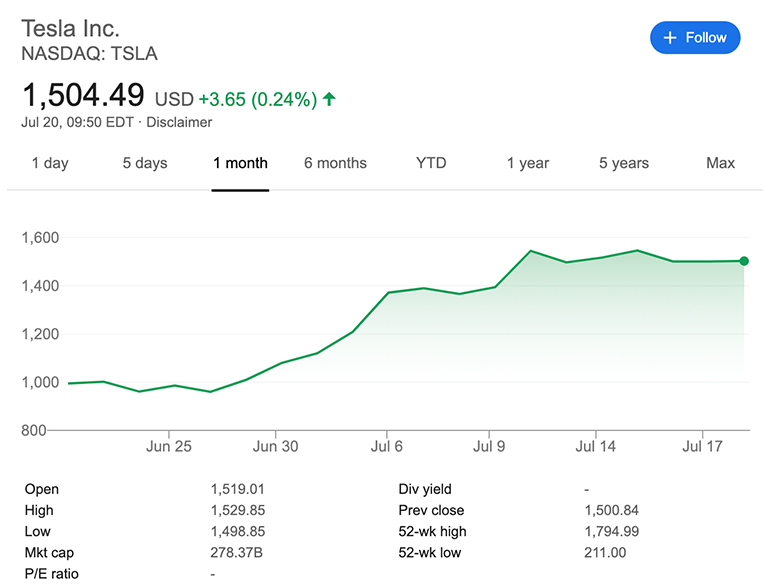

The financial statements of Tiziana Life Sciences say that the company does not bring any income. However, in the past few months, its shares have risen from $2.8 to $11.3 in price, and they now continue to grow. Accordingly, the capitalization of a small and unprofitable company grew by 300%.

This is not the first time that small companies receive capital inflows due to investors’ mistakes. In April last year, a similar confusion with tickers led to a rise in the price of communications equipment manufacturer Zoom Technologies (ticker ZOOM) by a record of 47,000%. Investors simply confused it with Zoom Video Communications (ticker ZM), one of the largest video conferencing services.

Similarly, the Chinese real estate service Fangdd Network Group, whose ticker is FAANG, managed to grow. Its the stock price rose from $10 to $129. This is an abbreviation known to everyone that is used in the stock market and consists of the first letters of the largest IT giants of the world market: Facebook, Apple, Amazon, Netflix, and Google.