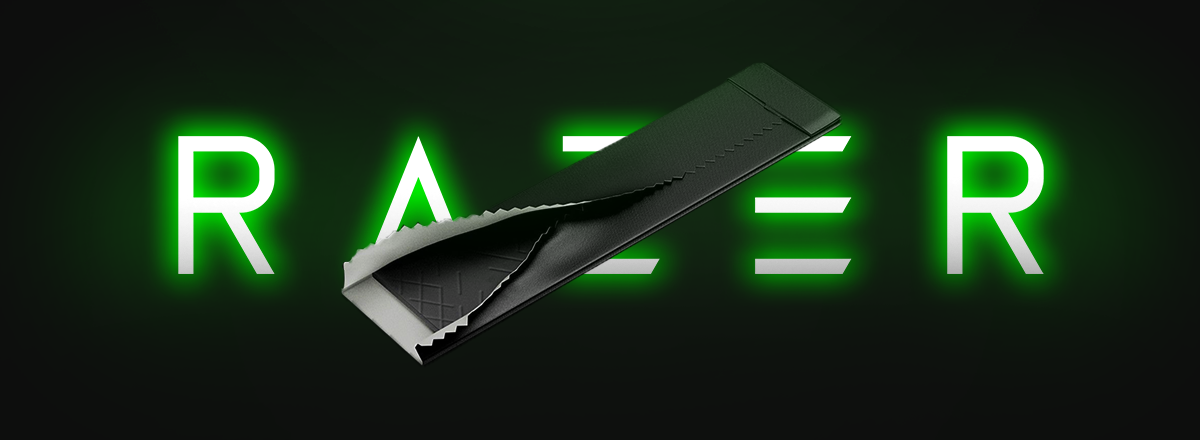

Razer, known primarily for its gaming hardware, has opened a banking niche. Razer decided not to lag behind Apple, Samsung, Huawei, and Google. Razer has teamed up with Visa to launch its prepaid payment card, which is called the Razer Card.

The Razer Prepaid Card is tied to the Razer Pay proprietary payment service. It is available both in the virtual version and in a plastic one with an NFC chip for contactless payments.

Razer Card is black with a Razer signature backlit logo. It is the first payment card that lights up on payment. The Razer logo lights up green with every contactless payment, a small electrical charge is enough to power the built-in LED when it contacts the payment terminal.

The LED backlighting has the Premium card, while the base card has only green-painted edges.

Like other payment products, the Razer Card can be used to pay for goods and services, including online purchases. Among the main advantages of the Razer Card are the cashback program and in-game bonuses. Razer cardholders can expect 1% cashback on purchases in select stores and 5% on purchases from the Razer Online Store.

In the beginning, there will be an increased cashback of 10% instead of 5%. There are no restrictions on the maximum cashback amount. Razer also plans to launch a competition with a total of $2,000 in computer peripherals.

The Razer Card is currently only available in Singapore as part of its beta testing program. Beta testing is now open exclusively to 1,337 users.

The launch date is still unknown, neither is the international release of the product.